While 72 per cent of Canadian mortgage shoppers get mortgage advice in person, a majority would opt for a fully online mortgage to save money, according to a new survey by Rates.ca.

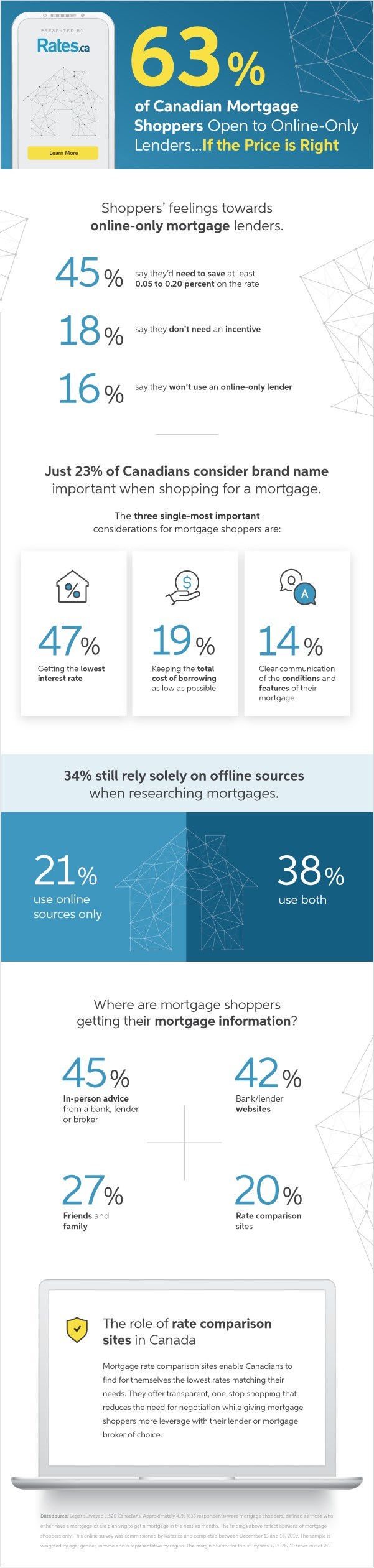

Almost one in five mortgage shoppers say they’d be “happy to get a mortgage without talking to people on the phone or in person.” But, an additional 45 per cent would consider it, if it meant getting a lower interest rate. For this 45 per cent, the rate savings would have to be at least 0.05 to 0.20 percentage points to sway them away from lenders who employ in-person or phone advisors. (A rate that’s 0.20 percentage points lower saves you about $195 a year per $100,000 of mortgage.)

“Just as we saw with online stock brokerages a few decades ago, a growing segment of borrowers is willing to make their own mortgage decisions online without a banker’s advice,” said Rob McLister, Mortgage Editor at Rates.ca.

Canadian mortgage shoppers also care less about a lender’s brand name when a great rate is at stake. Fewer than one-quarter (23 per cent) say the lender brand is important when shopping for a mortgage.

For most mortgage shoppers, getting the best rate surpasses all other considerations by a large margin. Three out of four (75 per cent) say getting a low rate is an important factor when choosing a mortgage, with 47 per cent of respondents citing it as their number one mortgage goal.

Interestingly, only 19 per cent said the lowest overall borrowing cost is their main goal, followed by 14 per cent citing clear communication of mortgage terms and conditions.

“The lowest total borrowing cost, which includes interest, fees and penalties, always matters more than the lowest rate,” said McLister. “But people continue to mistakenly associate the lowest rate with the greatest savings.”

Rates.ca recommends a four-step method to minimize borrowing costs:

|

1) |

Research and get advice on the optimal mortgage term given your specific five-year plan |

|

2) |

Compare the lowest rates for that term on a rate comparison website (pay attention to the fine print in the rate details) |

|

3) |

Call the lender or mortgage broker advertising the rate and ask them to outline all significant restrictions and features of the rate (including things like the prepayment penalty calculation method, the time you’re given to port the mortgage to a new property and whether you can borrow more money before maturity with no penalty). |

|

4) |

Pick the best overall value based on this research. |

For more on the survey findings, visit Rates.ca.

Tweet